| ● Annual election of directors ● 91% independent directorsAnnual advisory say-on-pay vote

● LeadAll director nominees other than our CEO are independent director

● RobustLimit on directorships a Board member can hold

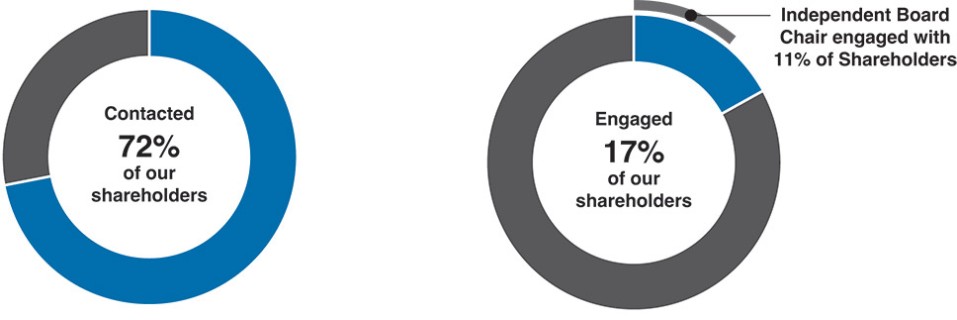

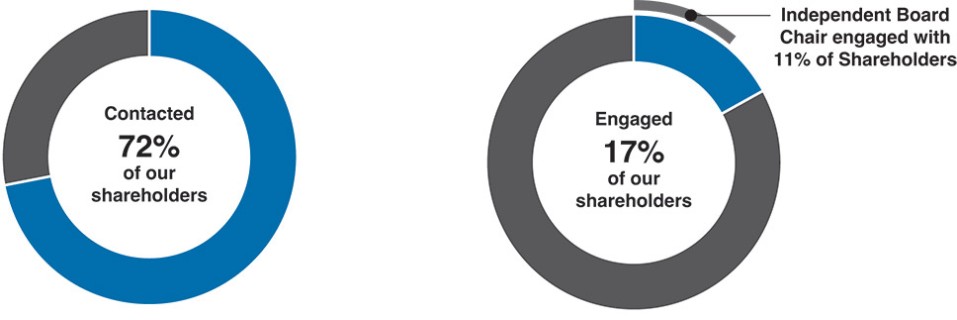

● Rigorous stock ownership guidelines for directors and certain key executives ● Anti-hedging and anti-pledging policy ● Ongoing succession planning for CEO, executives,executive leadership team and directors | 44% new directors since 2021 ● Proxy access rights for shareholders | ● Board committee oversight of environmental, social, and governance (“ESG”) matters ● Annual boardBoard and committee self-assessments and individual director peer evaluations ● Resignation policy for directors not receiving a majority vote (see description below under subheading “Director Resignation Policy”) ● Active shareholder engagementsengagement (see description below under subheading “Shareholder Feedback and 2023 Say-on-Pay”) ● Clawback PolicyAdoption of Dodd-Frank compensation clawback policy and retention of existing incentive compensation clawback policy

● Worldwide Code of Business Conduct and Ethics, applicable to all directors, executive officers, and employees ● No shareholder rights plan (“poison pill”) |

| | | | 12

|

|

|

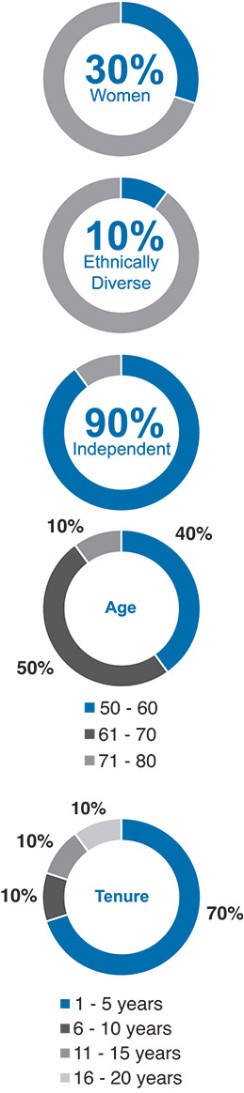

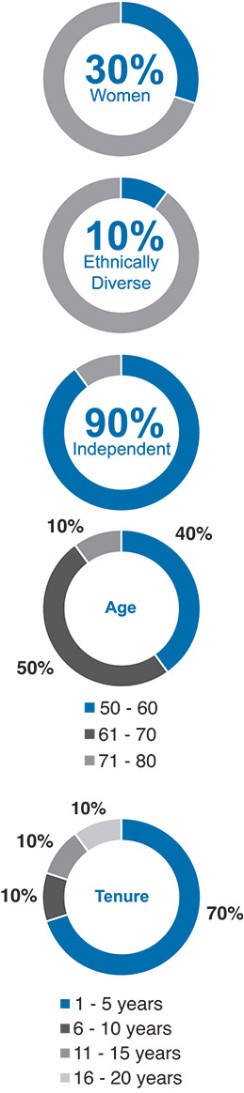

COmmitment to board diversity Arrow is committed to building the right Board that consists of the optimal mix of skills, expertise, and diversity capable of effectively overseeing the execution of our business. The Board consists of highly engaged, independent, and diverse directors that are actively involved in strategic, risk, and management oversight. TheArrow Board prioritizes diversity in its recruitment of directors and has retained a recruitment firm to assist the Board in actively recruitingidentifying and evaluating potential diverse Board candidates.candidates with the expectation that candidate slates should include women and candidates of underrepresented race/ethnicity in addition to other diverse characteristics, which both supplement and complement the existing Board. Arrow is committed to building a Board with a wide range of skills, experience, expertise, and diversity. Arrow’s Board consists of highly engaged, independent, and diverse directors that are actively involved in, among other things, strategic, risk, and management oversight.

Board Refreshment The Board believes the fresh perspectives brought by newer directors are critical to a forward-looking and strategicstrategic-minded Board when appropriately balanced with the deep understanding of Arrow’s business and independent institutional knowledge provided by longer-serving directors. Accordingly, Arrow has maintained a deliberate mix of new and tenuredlonger-tenured directors on the Board, and the Corporate Governance Committee is focused on ensuring the optimal mix of tenures, backgrounds, skills, and perspectives is optimal for Arrow. Consistent with that effort, in 2020,Since 2019, Arrow welcomed Mr.has added six new directors – Messrs. Austen, Smith, Garcia, and Mr. SmithKerins, and Mses. Lowe and McDowell – each of whom have different backgrounds and experiences to further enhance the oversight of Arrow’s strategic goals and initiatives and contribute to the Board.development and expansion of the Board’s knowledge and capabilities. As part of the Board’s active and comprehensive Board refreshment efforts, the Board has nominated a new director, Michael D. Hayford, for election to the Board at the Annual Meeting. 8 |

| |

Snapshot of Director Nominees Below is a snapshot of the expected composition of Arrow’s Board immediately following the 2021 Annual Meeting, assuming the election of the ten (10) nominees named in thethis Proxy Statement. The slate of ten (10) director nominees includes three (3) female nominees and one (1) ethnically diverse nominee. Skill/Experience | Nominees |

|

| CEOLeadership Experience

| 810

| |

| “Financial Expert” for Regulatory Purposes

| 3

|

|

| Risk Management Experience | 86

| |

| Global Business and Operations Experience | 10 | |

| Financial Experience | 8 | |

| Legal and Regulatory Oversight Experience | 72

| |

| Technology and Cybersecurity Experience | 68

| |

| Supply Chain Management Experience | 5 | |

| Crisis Management Experience | 86

| |

| Strategy and M&A Experience | 10 | |

| Brand and Marketing Experience | 6 | |

| Corporate Governance Experience | 117

| |

| Human Capital Experience | 8 | |

| Environmental and Climate Strategy Experience | 5 | |

|

| 9 |

| | |

|

| 13

|

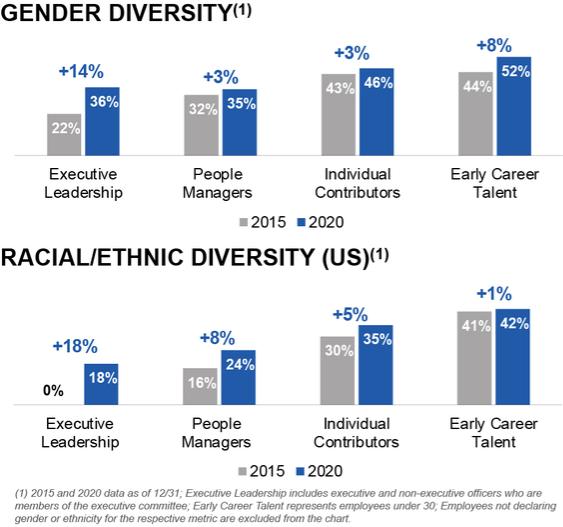

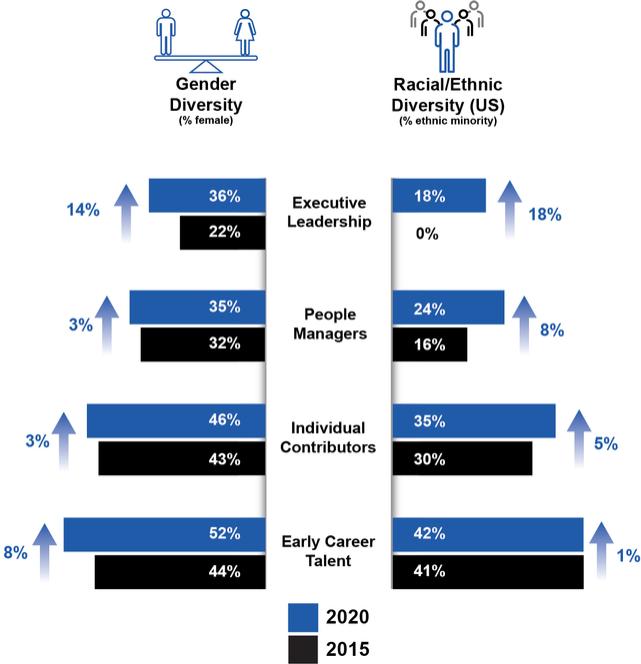

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE OVERVIEW At Arrow, we believe that doing good is good for business and our global community. We monitor and manage our ESG opportunities and impacts and engage with shareholders and other stakeholders with the goal of creating a better tomorrow and assuring the long-term viability of our Company. To demonstrate Arrow’s commitment to the importance of these efforts, quantitative performance objectives related to carbon emission reduction and diversity and equality-related measures were components of our executive annual cash incentive plan for 2022 and 2023. Arrow intends to continue to evolve and integrate ESG into our strategy and operations and related disclosures. To learn more, please refer to our 2023 ESG Report, available on our website at arrow.com/ESG. The 2023 ESG Report details Arrow’s ESG-related annual goals, progress updates, metrics, and initiatives. We invite you to review the 2023 ESG Report and share your thoughts with us at ESG@arrow.com. Information on the Company’s website, including our ESG Reports, is not incorporated by reference into, and does not form part of, this Proxy Statement or any other report or document Arrow files with the SEC. ENVIRONMENTAL HIGHLIGHTs

| Arrow is committed to reducing its environmental footprint. Our approach to environmental management focuses on the operation of our business. This means the use of environmentally friendly technologies, avoidance of emissions, reducing waste and the use of energy saving solutions.

| In 2020, Arrow maintained a silver EcoVadis rating for our ESG/CSR achievements globally.

Arrow is committed to continuous improvement, including releasing its SASB disclosure beginning this year, and additional disclosures guided by other standards in the coming years.

For more information on our commitment to sustainability and our ESG/CSR efforts, please see Arrow’s SASB and CSR reports that can be found on our website at www.arrow.com. Information found on our website is not incorporated by reference into this Proxy Statement.

|

Environmental Management

Systems Certifications

|

| Greenhouse Gas (GHG)

Emissions Reduction

| ●

Arrow voluntarily complies with internationally recognized environmental management system industry quality standards. Arrow is ISO 14001 certified in strategic global warehouse locations.

●

Arrow sites in the U.K. are ISO 50001 certified, the international standard for establishing, implementing, maintaining, and improving an energy management system.

|

| ●

One of Arrow’s largest sources of carbon emissions is corporate travel. Due to COVID-19, Arrow reduced its corporate travel significantly. Prior to COVID-19 disruptions, one of the avenues by which Arrow has historically reduced travel and proven efficiency is through the utilization of the Microsoft Teams platform for telecommunications and collaboration, allowing for remote work.

|

Environmental Management

Arrow’s decision in North America to recycle and purchase recycled products benefited the environment in the following ways in 2020:

|

|

|

|

|

| 2,123 | 621 | 497 | 39,291 | 1,546,718 | 55,041 | trees preserved | cubic yards

of landfill

space

conserved | metric tons

of GHG

emissions

avoided | kilowatt-hours

of energy

avoided | gallons of

water

avoided | gallons

of gasoline

saved |

| | | | 14

|

|

|

Award-winning orgANIZATION

| | | |

|

World’s Most

Admired Company

|

| Over the past two decades, Arrow has been named by Fortune as a World’s Most Admired Company 20 times and has topped the “Wholesalers: Electronic and Office Equipment” category for eight consecutive years. The World’s Most Admired list recognizes companies based on nine key attributes of reputation, including innovation, quality of products/services, global competitiveness, people management, and social responsibility.

| | | | | | | | |

|

Top 50 Most Admired Companies for HR

|

| In 2020, Arrow was once again named as one of the Top 50 Most Admired Companies for HR. Management consulting firm, Korn Ferry, partners with Human Resource Executive each year to select companies for the Most Admired for HR list from Fortune’s World's Most Admired Companies list. The Most Admired for HR award focuses on four HR-related attributes: management quality, product/services quality, innovation, and people management. 2020's Most Admired for HR selection was aimed primarily at companies, and their respective HR organizations, that are enabling workforce transformation. At Arrow, our workforce transformation is powered by our common purpose: making the benefits of technology accessible to all. This, in turn, powers the personal greater good of making the benefits of career and livelihood accessible to all of our employees around the world.

| | | | | | | | |

|

Best Place

to Work For

Equality

|

| For the third year in a row, Arrow received a perfect score of 100 percent on the Human Rights Campaign Foundation’s 2021 Corporate Equality Index and was designated a “Best Place to Work for LGBTQ Equality.” The Corporate Equality Index is the nation’s top benchmarking survey and report measuring corporate policies and practices related to the LGBTQ workplace, including non- discrimination policies, employment benefits, demonstrated competency and accountability around LGBTQ diversity and inclusion, public commitment to LGBTQ equality, and responsible citizenship.

| | | | | | | | |

|

Edison Award

|

| Collaborating with Arrow to bring technology to all, a team of 40 MIT students captured the 2020 Edison Gold Award for its Hyperloop II electric hovercraft and was named the top entry in the category of Transportation/NextGen Logistics. Arrow provided engineering mentorship, components sourcing and logistics support as part of its team sponsorship. The Hyperloop II, a fully functioning high-speed, frictionless vehicle designed to carry people or freight using air levitation technology, was recognized by the Edison Award judges as “a game-changing innovation standing out among the best new products and services.” Arrow has won an Edison Award for the last three consecutive years.

|

| | |

|

| 15

|

CORPORATE SOCIAL RESPONSIBILITY STORIES

Innovating Mobility: The Arrow SAM Car

|

|

| Twenty years after he was injured in a racing accident, disabled IndyCar driver Sam Schmidt returned to auto racing with the help of Arrow. Driving a 2020 Corvette C8 modified with electronic head controls, Schmidt bested more than a dozen able-bodied drivers in a two-day competition. Schmidt had not raced competitively since crashing during a 200-mph practice lap in 2000, an accident that left him paralyzed from the shoulders down.

| | Arrow engineers modified the Corvette with a suite of electronic modifications to create a semi-autonomous motorcar (SAM) that Schmidt can safely and competitively operate at high speeds. Sensors on a headset connect to infrared cameras that track his head motions left and right to steer the car. A sip-and-puff device helps him accelerate and brake the car with his breath. His voice commands other systems. Arrow does not sell the SAM technology but makes the driving solution available to innovators for broader independent living applications.

Said Schmidt: “I never thought I would feel this freedom again. If you are able-bodied, technology makes life easier. But for people with disabilities, it gives us a level of independence and provides opportunities we haven’t seen before. This technology could eventually help a disabled person simply drive themselves to work—that's the one thing most disabled people want to do.”

| Innovating Tomorrow: Anti-Bullying App

|

|

| Arrow honored California eighth-grader Aryan Mangal with our 2020 Innovation in Electronics Award at the fifth annual Invention Convention in association with the Henry Ford Museum. Held virtually, the worldwide competition showcased nearly 500 K-12 inventors and entrepreneurs. To participate, students were required to submit a video presentation of their invention, a prototype, an inventor’s logbook showing the journey of their invention process and a poster board highlighting key points of the invention process. Competitors were selected from more than 120,000 K-12 inventors who first highlighted their inventions at local affiliate events.

| | The program teaches students problem-identification, problem-solving, entrepreneurship and creativity skills.

Mangal’s invention, Artemis: An App for Abuse Prevention by Analyzing Sound through Machine Learning, evaluated sound samples to detect patterns that could potentially determine and deter bullying. Mangal continuously scanned incoming sound using a battery-powered tiny edge computing device. When profanity or threatening language was detected, a red LED light on the device would start blinking and recording the language, which could be sent to school officials or other authorities.

| Innovating Mobility: TrachTech wins Arrow Electronics People’s Choice Award

|

|

| An undergraduate team from Tulane University captured the Arrow Electronics People’s Choice Award at the 2020 Collegiate Inventors Competition for developing a new device to safely clean ventilator tubes. TrachTech is specifically designed to efficiently remove biofilms and debris from the tubes and maintain continued airflow from ventilators during the cleaning process. With ventilators in high demand due to the ongoing COVID-19 pandemic, keeping these machines clean and safe is essential.

| | The Collegiate Inventors Competition is a program of the National Inventors Hall of Fame and is sponsored by the US Patent and Trademark Office (“USPTO”) and Arrow. Competing teams develop and prototype technology solutions to the world’s most pressing problems.

The TrachTech team was one of ten finalists representing nine colleges and universities from across the United States vying for the Arrow prize in the annual competition, which highlights innovation and emerging technological trends from U.S. campuses. Because of COVID-19 restrictions, the finalists – five undergraduate and five graduate teams – presented their inventions in a virtual format to an esteemed panel of final-round judges composed of Hall of Fame inductees and USPTO officials.

|

| | | | 16

|

|

|

PROPOSAL 1: ELECTION OF DIRECTORS THE BOARD RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES NAMED BELOW. If elected by our shareholders at the Annual Meeting, each nominee will serve for a one-year term expiring at our 2025 annual meeting of shareholders. Each nominee for election as a member of the Board is to be elected todirector will hold office until his or her successor has been elected and qualified or until the next Annual Meeting.director’s earlier resignation or removal. All nominees identified below, except Michael D. Hayford, are current members of the Board. They have been recommended for re-election to the Board by the Corporate Governance Committee and approved and nominated for re-election by the Board. In accordance with the Company’s amended corporate bylaws (“bylaws”by-laws (the “By-laws”), the eleventen (10) nominees receiving a plurality of votes cast at the Annual Meeting will be elected directors, subject to the Director Resignation Policy described below. An uncontested election of directors is not considered “routine” under the New York Stock Exchange (“NYSE”) rules. As a result, if a shareholder holds shares in “street name” through a broker, fiduciary, or other nominee,custodian, the broker, fiduciary, or nomineecustodian is not permitted to exercise voting discretion with respect to this proposal. For this reason, if a shareholder“street name” holder does not give histhe broker, fiduciary, or her broker or nomineecustodian specific instructions, the shareholder’s shares will not be voted on this proposal. If youproposal, which is referred to as a “broker non-vote.” Broker non-votes and withholding authority to vote to “abstain,” your shares will be counted as present at the meeting, and your abstentionfor a director nominee will have no effect on the effectoutcome of this proposal (though a vote againstdirector nominee that receives a greater number of “WITHHELD” votes than “FOR” votes in an uncontested election is required by the proposal.Board’s Director Resignation Policy to tender his or her resignation to the Board, as discussed in greater detail below under the heading “Director Resignation Policy”). BOARD MEMBERSHIP REQUIREMENTS In accordance with the Company’s corporate governance guidelines,Corporate Governance Guidelines, members of the Board should have the following skills and abilities: | > | the education, business experience, and current insight necessary to understand the Company’s business; |

| > | the ability to evaluate and oversee direction, performance, and guidance for the success of the enterprise;Company; |

| > | the ability to primarily represent the interests of the Company’s shareholders while being attuned to the needs of the Company’s employees, communitythe communities in which it operates, and other stakeholders;stakeholders, insofar as such conditions impact long-term shareholder value; |

| > | the ability to devote the necessary interest and time to fulfill all director responsibilities over a period of years, including committing to prepare for, attend, and meaningfully participate in substantially all scheduled Board and Board committee meetings; |

| > | independence and strength of conviction coupled with the ability to leave behind personal prejudice so as to be open to otherdifferent points of view; |

| > | the willingness and ability to appraise the performance of executive management objectively and constructively and, when necessary, recommend appropriate changes; and |

| > | avoid any activity or interest that might, or might appear to, conflict with his or her fiduciary responsibilities to the Company, except in unusual circumstances and then only with the formal approval of disinterested directors; and |

| > | all other criteria established by the Board from time to time, including functional skills corporate leadership, diversity, international experience, or other attributes which will contribute to the development and expansion of the Board’s knowledge and capabilities. |

| | |

|

| 1711

|

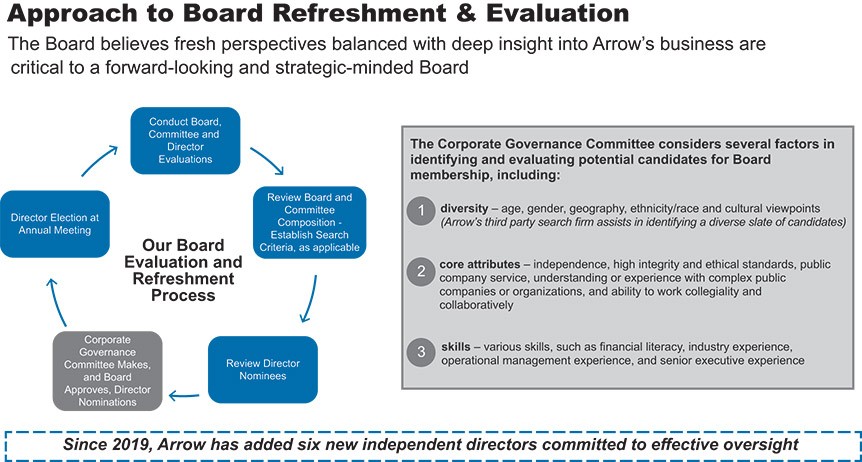

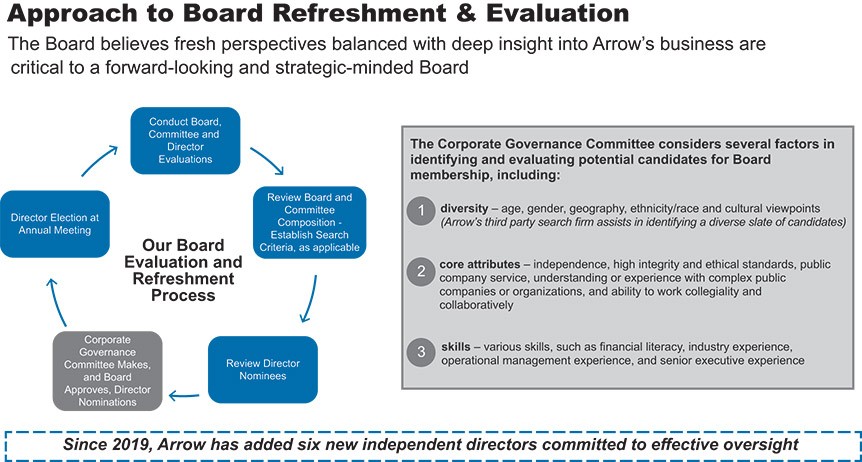

BOARD EVALUATION, NOMINATIONS AND SUCCESSION During the Company’s annual Board evaluation and nomination process, the Corporate Governance Committee evaluates the Company’s directors in light of current needs of the Board and the Company. In addition, during the course of the year, the Corporate Governance Committee discusses Board succession and reviewsevaluates potential Board candidates. The Corporate Governance Committee has retained a third partythird-party recruitment firm to assist in identifying and evaluating potential Board nominees. The Company’s annual director nomination process involves formal assessments of qualifications, skills, and attributes necessary for successful contributions at the Board, Board committee, and individual director levels under the direction of the Corporate Governance Committee Chair.levels. This process assists the Board in determining who it should nominate to stand for election based on Company and Board needs.election. In addition, the Corporate Governance Committee’s Board candidate nomination process includes the continual evaluation ofCommittee continually evaluates potential new candidates for Board membership, which is taken into account when it takes into consideration when recommending to the Board a slate ofrecommends nominees for election at each annual meeting of shareholders.election. The Corporate Governance Committee considers a number of different factors in evaluating BoardCompany uses the following process for assessing needs, identifying candidates, including:and nominating new director candidates for election. | > | diversity-enhancing qualities –age, gender,Conduct Board and diverse backgrounds;Committee Evaluations. As required by the Company’s Corporate Governance Guidelines and the charters of the Audit Committee, the Compensation Committee, and the Corporate Governance Committee, the Board and each Board committee conduct annual self-evaluations of the effectiveness of the Board and each such committee. |

| > | Review Board and Committee Composition and Establish Search Priorities. Utilizing the results of the Board and Board committee self-evaluations and taking into account the Company’s strategic interests, its industry and market, the qualifications set forth in the Company’s Corporate Governance Guidelines, and other relevant considerations, the Corporate Governance Committee, in consultation with the Board, identifies the desired skills, attributes, expertise, experience, and background that would enable one or more additional directors to add value to the Board and its committees. If the Corporate Governance Committee determines to initiate a director search, it may engage a director search firm and provide the parameters for the search. |

| > | coreReview Director Candidates. Once a director search identifies potentially suitable candidates, the Corporate Governance Committee, with input from the entire Board, makes a list of final candidates. This list also includes any candidates duly submitted by shareholders. The Board Chair, Chief Executive Officer, and selected members of the Corporate Governance Committee then meet with each candidate to evaluate his or her suitability for Board membership in relation to the skills, attributes, – independence, high integrityexpertise, experience, and ethical standards, public company service, understanding or experience with complex public companies or like organizations, and ability to work collegially and collaboratively with other directors and management; andbackground desired of a new director. |

| > | skills – financial literacy, industry experience, operational management experience, senior executive experience,Recommendation and other expertiseNomination of Candidates for Board. If, based on the above review process, the Corporate Governance Committee identifies one or more suitable potential Board candidates, the Corporate Governance Committee will recommend the candidate(s) to the Board, and the Board will determine whether to nominate such candidate(s) for election by the shareholders at the next annual shareholder meeting; provided that any vacancy on the Board may be importantfilled by a majority vote of the current Board, and any director elected by the Board to fill a vacancy will serve until the next annual shareholder meeting. |

| > | Director Election at Annual Meeting and Committee Assignments. All director nominees obtaining a plurality of the votes cast at the annual shareholder meeting will be elected to serve on the Board. At the Board meeting immediately following the annual shareholder meeting, the Corporate Governance Committee will make recommendations regarding, and the Board will ultimately approve, the committee assignments for the Company’s strategies.elected directors, including the committee chairs. |

12 |

| |

The below graphic summarizes the factors the Corporate Governance Committee considers in evaluating potential candidates for Board membership.

As a result of our comprehensive recruitment efforts, in 2023, the Company welcomed one new director to the Board, Ms. McDowell, who was elected to the Board at the 2023 annual shareholder meeting. In February 2024, the Corporate Governance Committee also recommended for nomination, and the Board nominated, Michael D. Hayford for election to the Board at the Annual Meeting. Mr. Hayford was identified by the Company’s third - party executive recruitment firm and, if elected to the Board at the Annual Meeting, will bring deep public - company and technology industry experience to the Company’s Board, as further described below under the heading “Biographies of Director Nominees.” The Corporate Governance Committee considers allshareholder recommendations of these relevant attributes of each Board candidate, withnominees as well as those recommended by current directors, officers, employees, and others. Such recommendations may be submitted to Arrow’s Chief Governance, Sustainability, and Human Resources Officer, Gretchen Zech, at Arrow Electronics, Inc., 9151 East Panorama Circle, Centennial, Colorado 80112, who will forward them to the goal of putting forth a diverse slate ofCorporate Governance Committee. Possible candidates with a combination of skills, experience, and personal qualities that will servesuggested by shareholders are evaluated by the Board and its committees,Corporate Governance Committee in the Company, and its shareholders well.same manner as other candidates. DIVERSITY Whenever the Corporate Governance Committee evaluates a potential candidate for Board membership, it considers that individual in the context of the composition of the Board as a whole. While we dothe Company does not have a formal diversity policy, that limits the selection of director candidates by the Corporate Governance Committee, the Board believes that its membership should reflect diversity in its broadest sense to include, among other factors, age, gender, geography, ethnicity/race, and consistentcultural viewpoints. Consistent with that philosophy, the Board has taken measures to diversify its makeup: | > | All but one of the Company’s director nominees (i.e., Mr. Kerins) are independent and they have a broad range of experience in varying fields, including, among others, software programmingdevelopment and sales, chemical distribution, business strategy consulting, hospitality services, semiconductor manufacturing, consumer products, electronics and energy.computer hardware manufacturing and distribution, business services, and telecommunication products and cloud services. |

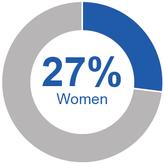

| > | Three30% of the Company’s directors, or 27%, of the entire Boarddirector nominees are women.women, and 10% are racially/ethnically diverse. |

|

| 13 |

| > | A majority of the Company’s directorsdirector nominees hold or have held directorships at other U.S. public companies. |

| > | SevenEight of the director nominees, in addition toincluding the Company’s Chairman and CEO, have served as chief executive officers, and all have demonstrated superb leadership, and intellectual, and analytical skills gained from deep experience in management, finance, and corporate governance. |

| > | The Board has retained a recruitment firm to assist the BoardCorporate Governance Committee in actively recruitingidentifying and evaluating potential diverse Board candidates.candidates and sets clear expectations that candidate slates should include women and candidates of underrepresented race/ethnicity in addition to other diverse characteristics, which both supplement and complement the existing Board. |

The Corporate Governance Committee is focused on continued diversity on the Board as it believes that the varied perspectives and experiences resulting from having a diverse Board enhance the quality of decision making. In particular, the Board is committed to identifying and evaluating highly qualified Board candidates who are women and/or are from an under-represented community as well as candidates with other diverse backgrounds, industry experience, and other unique characteristics. For example, three recent additions to the Board, Mary T. McDowell, Carol P. Lowe, and Fabian T. Garcia, have collectively added valuable gender, ethnic, and geographic/cultural diversity. The Corporate Governance Committee recognizes the evolving support for boards to achieve a target of 30% women representation. The Board currently has 33% gender diversity. If all of the Company’s director nominees are elected at the Annual Meeting, the Board would have 30% gender diversity. Over the course of 2024, the Board expects to continue to work closely with the Corporate Governance Committee to identify potential additions to the Board and expects to consider in its evaluation potential candidates’ diversity characteristics that may supplement and complement the existing Board. None of the Company’s director candidates are discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability, or any other basis proscribed by law. | | | | 18 14

|

| |

Director Nominee Diversity and Experience Matrix* | | | | | | | | | | | |

|---|

10 Director Nominees: | William

Austen | Fabian

Garcia | Steve

Gunby | Gail

Hamilton | Michael

Hayford | Andrew

Kerin | Sean

Kerins | Carol

Lowe | Mary

McDowell | Gerry

Smith |

|---|

Experience and Skills | | | | | | | | | | | Leadership | Leadership experience facilitates effective oversight of management, informs development of Company strategy, and enhances the Board’s succession planning process. | |

|

|

|

|

|

|

|

|

|

| Risk Management | Experience assessing and managing risk enables directors to effectively oversee and mitigate the most significant risks facing Arrow. | |

| |

| | |

|

|

| |

| Global Business and Operations | Background and experience managing global relationships and engaging with international stakeholders supports the Board’s oversight of key risks involving our global customer and supplier bases and of strategic decision-making relating to our complex worldwide business. | |

|

|

|

|

|

|

|

|

|

| Financial | Demonstrated financial experience enables in-depth analysis of our financial statements and informed decision-making regarding our capital structure, financial transactions, and financial reporting processes. | |

| |

|

|

| |

|

|

|

| Legal and Regulatory | Experience with legal and regulatory oversight enables directors to effectively oversee compliance with legal and regulatory requirements and the related policies, procedures, and controls for ensuring such compliance. | | | |

| |

| | | | | | Technology and Cybersecurity | Experience navigating the ever-changing technology landscape enables sharpened oversight of the innovative products, services, and systems central to our business and supports the Company’s long-term strategic planning. Experience with privacy and information security and cybersecurity oversight is critical to helping Arrow manage and plan to defend against significant cybersecurity risks. | |

| | |

|

|

|

|

|

|

| Supply Chain Management | Substantial knowledge of supply chain management enables enhanced oversight of our product and service offerings and sharpens focus on our business strategy to be the premier, technology-centric, go-to-market, and supply chain services company on the planet. | | | | | |

|

|

| |

|

| Crisis Management | In conjunction with the Board’s oversight of Arrow’s overall enterprise risk management, crisis management experience allows the Board to assist the Company in mapping out a crisis response plan and navigating a crisis in the rare event one should occur. | |

| |

| |

|

| | |

|

| Strategy and M&A | Experience in strategic planning and mergers and acquisitions is critical in formulating and implementing Arrow’s continued growth strategy. | |

|

|

|

|

|

|

|

|

|

| Brand and Marketing | Brand and marketing experience enables the Board to provide valuable insight into the alignment of brand definition with Arrow’s long-term strategy as a driver of value. | | |

|

|

|

|

| | |

| | Corporate Governance | Directors with experience in corporate governance assist the Company in implementing effective and compliant corporate governance practices for the benefit of our various stakeholders in the continually evolving corporate governance landscape. | |

| |

|

| |

| |

|

|

| Human Capital | Human capital management experience supports the Board’s oversight of the development, implementation, and effectiveness of practices, policies, and strategies relating to Arrow’s workforce, including talent attraction and development, corporate culture, and diversity and inclusion. | |

| |

|

|

|

|

| |

|

| Environmental and Climate Strategy | Experience in climate change risk management strategies and other climate-related issues enables enhanced Board oversight of environmental and climate related policies, strategies, compliance, and priorities. | |

|

|

| | |

| | | |

|

|

| 15 |

10 Director Nominees: | William

Austen | Fabian

Garcia | Steve

Gunby | Gail

Hamilton | Michael Hayford | Andrew

Kerin | Sean

Kerins | Carol

Lowe | Mary

McDowell | Gerry

Smith | Background | | | | | | | | | | | Gender Identity | | | | | | | | | | | Male |

|

|

| |

|

|

| | |

| Female | | | |

| | | |

|

| | Non-binary | | | | | | | | | | | Race | | | | | | | | | | | American Indian or Alaska Native | | | | | | | | | | | Asian | | | | | | | | | | | Black or African American | | | | | | | | | | | Hispanic or Latino | |

| | | | | | | | | Native Hawaiian or other Pacific Islander | | | | | | | | | | | White |

| |

|

|

|

|

|

|

|

| Age/Tenure | | | | | | | | | | | Age | 65 | 64 | 66 | 74 | 64 | 60 | 62 | 58 | 59 | 60 | Years on the Board | 4 | 3 | 7 | 16 | 0 | 14 | 2 | 3 | 1 | 4 |

* This matrix illustrates the experience, skills, qualifications, and characteristics of the individuals nominated for election to the Board at the Annual Meeting, based on information self-reported to the Company by each applicable individual. 16 |

| |

BIOGRAPHIES OF DIRECTOR NOMINEES Based on each nominee’s experience, attributes, and skills, which exemplify the sought-after characteristics described above, the Corporate Governance Committee has concluded that each nominee possesses the appropriate qualifications to serve as a director of the Company.

Independent DirectorBoard Chair

Committees:

Compensation

| Barry W. PerrySteven H. Gunby

| Age: 7466 Director Since: 19992017 | | CAREER HIGHLIGHTS | | Lead Director of the CompanyFTI Consulting, Inc., a business advisory firm

● President, Chief Executive Officer, and a director (a public company) since 20112014. Englehard CorporationThe Boston Consulting Group

● Chief Executive OfficerSenior Partner and Global Leader of Transformation from 2010 to 2014.

● Senior Partner and Chairman, North and South America from 2003 to 2009. ● Held other major managerial roles in his capacity as a Senior Partner and Managing Director, such as serving as a member of the Board of Engelhard Corporation, a surface and materials science company, from 2001 to his retirement in 2006.BCG’s Executive Committee. | Albemarle Corporation (a private company) and Ashland Global Holdings Inc.Breakthru Beverage Group LLC

● A director of Albemarle Corporation(a private company) from 20102016 to 2018, and Ashland Global Holdings Inc. from 2007 to 2019.2018. | | REASONS FOR NOMINATION While he was Chief Executive OfficerAt FTI, Mr. Gunby’s focus as President and CEO has been turning FTI into a vibrant, profitable growth engine, through significant operational, strategy, cultural, and leadership changes. At BCG, Mr. Gunby also focused on transformative growth, helping move the Americas operation from a period of Engelhard Corporation,flat headcount growth and diminished profitability to double-digit headcount and revenue growth, and substantially higher profit growth. The Board believes that Mr. Perry established the company’s vision and strategy, selected key management personnel, and evaluated the risks of participating in various markets. Further, hisGunby’s experience as a directorPresident and CEO of a number of public multinational companies providescompany, which has given him with the skills to objectively and accurately evaluate the financial performanceextensive experience in human capital management and corporate strategiesgovernance (among other things), and his proven record of accomplishments make him a large company.valuable member of the Board. As Board Chair, Mr. Gunby has demonstrated strong leadership and effective functioning and governance of the Board.

CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●FTI Consulting, Inc. |

Independent Director

Committees: AuditCompensation & Corporate Governance (Chair)

| William F. Austen | Age: 6265 Director Since: 2020 | | CAREER HIGHLIGHTS | | Bemis Company, Inc., a global manufacturer of flexible packaging products and pressure-sensitive materials ● President, Chief Executive Officer, and CEO since 2014. ●

A director from 2014 until Bemis was acquired by Amcor Limited in 2019.

● Executive Vice President and Chief Operating Officer from 2013 to 2014. ● Group President of Global Operations from 2012 throughto 2013. ● Vice President of Operations from 2004 to 2012.

| Morgan Adhesives Company ● President and Chief Executive Officer from 2000 to 2004. General Electric Company ● Various positions from 1980 untilto 2000. Tennant Company ● A director since 2007.(a public company) from 2007 to 2022. Arconic Corporation ● A director since 2020.(a public company) from 2020 to 2023. | REASONS FOR NOMINATION As President and CEO of Bemis, a complex global material science and manufacturing company, Mr. Austen gained expertise in global manufacturing and operations, together with experience in international mergers and acquisitions and business integration. The Board believes that Mr. Austen’s experience with building high-performance, cross-functional teams coupled with his engineering background will make him particularly valuable in guiding strategy for the Company’s engineering services. OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●Tennant Company ●Arconic Corporation

None |

| | |

|

| 1917

|

Independent Director

Committees: Audit &

Compensation | Steven H. GunbyFabian T. Garcia

| Age: 6364 Director Since: 20172021 | | CAREER HIGHLIGHTS | | FTIUnilever PLC., a British multinational consumer goods company

● President, Personal Care, and member of the Unilever Leadership Executive since 2022. ● President, Unilever North America, and member of the Unilever Leadership Executive from 2020 to 2022. The Boston Consulting Group, an American global management consulting firm ● Senior Advisor for consumer-packaged goods from 2018 to 2019. Revlon, Inc. (“FTI”) ● President, Chief Executive Officer, and a director since 2014.from 2016 to 2018. The Boston Consulting Group (“BCG”)Colgate-Palmolive Company

● Various positions from 2003 to 2016, beginning as President, Asia Pacific & Greater Asia Division, continuing as President, Latin America & Global Leader of Transformation from 2010 to 2014.Sustainability, and culminating as Chief Operating Officer, Global Innovation and Growth. | The Timberland Company ● Senior Partner and Chairman, North and South AmericaVice President, International Relations, from 20032002 to 2009.2003. Chanel Ltd. ● Held other major managerial rolesPresident, APAC and Member of the Executive Committee from 1996 to 2001.

Procter & Gamble Company ● Various positions in his capacity as a Senior Partnerthe U.S., Japan, Taiwan, Venezuela, and Managing Director, such as serving as a member of BCG’s Executive Committee.Colombia, from 1980 to 1994. | Kimberly-Clark Corporation

● A director (a public company) from 2011 to 2019. | REASONS FOR NOMINATION At FTI, Mr. Gunby’s focus has been turning FTI intoGarcia is a vibrant, profitableglobal business leader with a strong track record and deep experience, including his tenure as a public company CEO, with a keen understanding of global business strategy, international innovation and growth, engine, throughgeopolitical sensitivities, and financial, operational, changes, changes in strategy, and significant changes in culture and leadership. At BCG, Mr. Gunby also focused on transformative growth, helping move the Americas operation from a period of flat headcount growth and diminished profitability to double digit headcount and revenue growth, and substantially higher profit growth.strategic leadership skills. The Board believes that Mr. Gunby’sGarcia’s multicultural and global experience as a Presidentis especially valuable in guiding the Company’s international strategy and CEO offostering sustainable business practices and an international consulting firm, which includes extensive human capital management experience, and his proven record of accomplishments make him a valuable member of the Board.inclusive corporate culture.

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●FTI Consulting, Inc.None |

18 |

| |

Independent Director

Committees: Audit & Corporate Governance | Gail E. Hamilton | Age: 7174 Director Since: 2008 | | CAREER HIGHLIGHTS | | Symantec Corporation (“Symantec”) ● Executive Vice President from 2000 tountil her retirement in 2005. Compaq Computer Corporation ● Vice President and General Manager of the Communications Division from 1997 to 2000. Hewlett-Packard Company ● General Manager of the Telecom Platform Division from 1996 to 1997. | OpenText Corporation ● A director (a public company) since 2006. Ixia (acquired by Keysight Technologies in 2017) ● A director (a public company) from 2005 to 2017. Westmoreland Coal Company ● A director (a public company) from 2011 to 2019. | REASONS FOR NOMINATION Ms. Hamilton was responsible for designing, manufacturing, and selling electronic systems for more than 20 years. While at Symantec, a leading software company, Ms. Hamilton oversaw the profit and loss and operations of the enterprise and consumer business. In that role, she was also responsible for business planning and helped steer the company through an aggressive acquisition strategy. She also oversaw Symantec’s cybersecurity function and services. The Board believes that Ms. Hamilton’s experience at Symantec a leading software company, makes her particularly valuable in providing guidancehelping to guide the direction and strategy of Arrow’s Enterprise Computing Solutions business with regardas well as brings to its direction and strategy.the Board insight into oversight of cybersecurity matters. OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●Open Text Corporation |

| | | | 20

|

|

|

Independent Director

Committees:

Compensation &

Corporate Governance

| Richard S. HillMichael D. Hayford

| Age: 6964 Director Since: 2008-- | | CAREER HIGHLIGHTS | | SymantecNCR Corporation, a public global payments and technology platform company

● Chief Executive Officer from 2018 to 2023. ● A director (public company) from 2018 to 2023. Motive Partners ● Interim Chief Executive OfficerFounder and a director in 2019.Senior Advisor from 2015 to 2018.

Novellus Systems,Fidelity National Information Services, Inc.

● Executive Vice President and Chief Financial Officer from 2009 to 2013. National Infrastructure Advisory Council, an executive-branch council focused on critical infrastructure security and resilience ● Member since 2022 (appointed by the President of the United States). | Metavante Technologies, Inc. ● A director (public company) from 19932007 to 2012, Chief Executive Officer and Chairman of the Board from 2006 until 2012.2009. Marvell Technology Group Ltd.

● Chairman of the Board since 2016.President and Chief Operating Officer from 2007 to 2009.

Xperi Corporation (formerly Tessera Technologies, Inc.)

● Chairman of the BoardChief Financial Officer from 20122001 to 2020 and as interim Chief Executive Officer in 20132006.

CMC Materials, Inc.

● Lead director since 2012.Other senior positions of increasing seniority from 1992 to 2001.

| Yahoo! Inc.Endurance International Group Holdings

● A director (public company) from 20162013 to 2017.2018. Autodesk, Inc.West Bend Mutual Insurance Company

● A director (private company) from 20162006 to 2018. Planar Systems, Inc.

●

A director from 2013 to 2015.

University of Illinois Foundation

●

Chairman and executive committee member from 2002 to 2014.

SemiLEDs Corporation

●

A director from 2010 to 2012.

| REASONS FOR NOMINATION

Mr. Hill has had a broad base of experience as the Chief Executive Officer of Novellus. In that role, he set the strategy by evaluating market risks to determine the ultimate direction of that company. Novellus was in the business of developing, manufacturing, and selling equipment used in the fabrication of integrated circuits. As a result, Mr. Hill has a thorough understanding of the semiconductor market in which Arrow operates. He also has experience in the international marketplace as a result of serving on a number of boards for companies with global operations.

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

●CMC Materials, Inc.

●Marvell Technology Group, Ltd.

|

Independent Director

Committees:

Audit

| M. F. (Fran) Keeth

| Age: 74

Director Since: 2004

| | CAREER HIGHLIGHTS

| | Royal Dutch Shell plc

●

Executive Vice President from 2005 to 2006.

Shell Chemicals Ltd.

●

Chief Executive Officer and President from 2005 to 2006.

●

Executive Vice President of Customer Fulfillment and Product Business Units from 2001 to 2006.

| Shell Chemical LP

●

Served as President and Chief Executive Officer from 2001 to 2006.

Verizon Communications Inc.

●

A director from 2006 to 2019.

| REASONS FOR NOMINATION Mrs. Keeth’s knowledge and expertise helped guide the direction, culture,Mr. Hayford has strong strategic and operational excellenceleadership experience developed over an extensive career in technology, payments, and financial services. Mr. Hayford previously served as a public-company chief executive officer and chief financial officer and on multiple public-company boards of Shell Chemicals Limited. She helddirectors. Mr. Hayford also currently serves on a numberfederal advisory council to which he was appointed by the President of senior financialthe United States. The Board believes that Mr. Hayford’s experience in leading strategy, operational execution, and finance at large organizations positions including Principal Accounting Officer and Controller. As a result of this experience and associated expertise, Mrs. Keeth is considered an “audit committee financial expert” as the term is defined in Item 407(d) of Regulation S-K. In additionhim to her extensive financial expertise, Mrs. Keeth bringsbring valuable insight to the Board executive leadership experience as a Chief Executive Officer and a global business perspective from her service as an executive officer of a large multinational companyassist the Board in its focus on the Company’s operational efficiency, strategic execution, and her service on other public company boards.transformation.

CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None |

|

| 19 |

| | |

|

| 21

|

Independent Director

Committees: Compensation & Corporate Governance | Andrew C. Kerin | Age: 5760 Director Since: 2010 | | CAREER HIGHLIGHTS | | Towne Park,a hospitality and healthcare parking solutions provider ● Chief Executive Officer since 2017. The Brickman Group, Ltd. ● Chief Executive Officer and a director (a private company) from 2012 until 2016. | Aramark Corporation ● Executive Vice President and Group President, Global Food, Hospitality and Facility Services from 2009 to 2012. ● Executive Vice President and Group President, North America Food from 2006 to 2009. ● Elected as an executive officer as Senior Vice President in 2004. ● President, Aramark Healthcare and Education from 1995 to 2004. ● A number of other management roles within Aramark Corporation. Under his leadership were all of Aramark’s food, hospitality, and facilities businesses, including the management of professional services in healthcare institutions, universities, schools, business locations, entertainment and sports venues, correctional facilities, and hospitality venues. | REASONS FOR NOMINATION Mr. Kerin brings over 30 years of experience leading business service companies and building service teams across the globe. The Board believes that Mr. Kerin’s deep operational and strategic expertise in the service industry as the CEO of Towne Park and formerly at the Brickman Group, along with his more than 17-year career with Aramark, makes him a valuable asset to the Company’s board,Board, particularly as the Company continues to build its services businesses. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None |

20 |

| |

Independent DirectorPresident and Chief Executive Officer

Committees:

Audit

| LaurelSean J. KrzeminskiKerins

| Age: 6266 Director Since: 20222018 | | CAREER HIGHLIGHTS | | Arrow Electronics, Inc. ● President, Chief Executive Officer, and director since 2022. ● Chief Operating Officer from 2020 to 2022. ● President, Global Enterprise Computing Solutions from 2014 to 2020. ● President, North American Enterprise Computing Solutions from 2010 to 2014. ● Vice President, Storage and Networking from 2007 to 2010. | Granite Construction IncorporatedEMC Corporation

● Several sales, marketing, and professional services roles around the world from 1997 to 2007. Other Experience ● Various roles with Coopers & Brand Consulting and General Motors. | REASONS FOR NOMINATION Mr. Kerins has served for 17 years at the Company in progressively more senior leadership and executive roles. The Board believes Mr. Kerins brings value to the Board from his comprehensive understanding of the Company’s business and deep institutional knowledge of the Company. The Board believes that in Mr. Kerins’ role as CEO of the Company, Mr. Kerins can effectively communicate Board priorities to Company management and provide insight and feedback to the Board on behalf of Company management. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None |

Independent Director Committees: Audit (Chair) & Corporate Governance | Carol P. Lowe | Age: 58 Director Since: 2021 | | CAREER HIGHLIGHTS | | FLIR Systems, Inc., a thermal imaging company ● Executive Vice President and Chief Financial Officer from 2015 until 2018.2017 to 2021. Sealed Air Corporation ● Senior Vice President and Chief Financial Officer from 20132011 to 2015.2017. Carlisle Companies Incorporated ● President, Carlisle Food Service Products in 2011. ● President, Trail King Industries from 2008 to 2011. ● Vice President and Chief Financial Officer from 20102004 to 2013. ●

Vice President and Corporate Controller from 2008 to 2010.

| Gillette Company (merged into Procter & Gamble (“P&G”))

●

Several corporate and operational finance positions that included Finance Director for the North American business units of P&G’s subsidiaries, Duracell and Braun from 1995 to 2007.2008.

| Terracon (a private company)TCW Special Purpose Acquisition Corp.

● A director since 2017.(a public company) from 2021 to 2022. Limbach Holdings,EMCOR Group, Inc.

● A director (a public company) since 2018.2017. Other Experience ● A director of Duravant (a private company) since 2023. ● A director of Novolex (a private company) since 2021. ● Member of the Board of Visitors and Finance Committee, Fuqua School of Business since 2017. | REASONS FOR NOMINATION Ms. Krzeminski’sLowe has valuable experience as the chief financial officerand a depth of a listed company,knowledge in many aspects of finance, as well as business services, strategic planning, business development, and information technology. The Board believes that her in-depth knowledge and understandingrecord of generally accepted accounting principles, experience in preparing, auditing, and analyzing financial statements, understanding of internal controls over financial reporting, andinstilling knowledge-based, performance-driven cultures throughout her understanding of audit committee functions are highly valued qualities as a director.career enables her to provide insightful contributions to the Company. Ms. KrzeminskiLowe is considered an “audit committee financial expert” as the term is defined in Item 407(d) of Regulation S-K. OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●Limbach Holdings,EMCOR Group, Inc. |

Chairman, President, and Chief Executive OfficerIndependent Director

Committees:

Audit

| Michael J. LongMary T. McDowell

| Age: 6259 Director Since: 20082023 | | CAREER HIGHLIGHTS | | Arrow Electronics, Inc.Mitel Networks Corporation, a global provider of telecommunication products and cloud services

● Chairman of thePresident and Chief Executive Officer from 2019 to 2021.

● A director (private company) from 2019 to 2022, and Board since 2010.Chair from 2021 to 2022. Polycom, Inc., an audio and video technology developer ● Chief Executive Officer and President since 2009. ●

President and Chief Operating Officer of Arrowa director (private company) from 20082016 to 2009.

●

Senior Vice President from 2006 to 2008, and, prior thereto, Vice President for more than five years.

| Arrow Global Components

●

President since 2006.2018.

Arrow Enterprise Computing Solutions

●

President, North America and Asia/Pacific Components in 2006.

●

President, North America in 2005.

●

President and Chief Operating Officer from 1999 to 2005.

AmerisourceBergen CorporationThe Informa Group plc

● A director (UK public company) since 2006.2018. ● Senior Independent Director since 2021. | UCHealthBazaarvoice, Inc.

● A director (public company) from 2014 to 2016, and Compensation Committee Chair from 2015 to 2016. UBM plc. ● A director (UK public company) from 2014 to 2018. Autodesk, Inc. ● A director (public company) since 2019.2010. ● Compensation Committee Chair since 2012. Other Experience: ● Served as Executive Vice President at Nokia from 2004 to 2012. ● Served in various executive, managerial, and other positions with Compaq Computer Corporation and Hewlett-Packard Company. | REASONS FOR NOMINATION AsMs. McDowell has strong strategic and operational leadership experience developed over an extensive career in the technology industry, owing to her previous roles as chief executive officer of two global technology-focused organizations and the chair of a resultcorporate board of his numerous yearsdirectors. The Board believes that this background allows Ms. McDowell to effectively contribute to the Board’s overall leadership structure and provide valuable insights into the Company’s core businesses and the markets in leadership roles atwhich they operate. Ms. McDowell also has a proven track record leading strategic transformations and implementing cutting-edge innovation in the fast-moving technology space, including for global businesses with diverse product lines and extensive distribution networks, which the Board believes will help the Company develop, refine, and inimplement the distribution industry, Mr. Long understands the competitive nature of the business and has an in-depth knowledge of the Company, a strong management background, and broad executive experience.Company’s growth strategy.

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●Autodesk, Inc. ●AmerisourceBergen CorporationThe Informa Group plc (London Stock Exchange) |

22 |

| |

Independent Director

Committees: Audit & Corporate Governance

| Stephen C. Patrick

| Age: 70

Director Since: 2003

| | CAREER HIGHLIGHTS

| | Colgate-Palmolive Company

●

Vice Chairman in 2011 until his retirement.

●

Chief Financial Officer for approximately 14 years.

●

In his more than 25 years at Colgate-Palmolive, he held positions as Vice President, Corporate Controller, and Vice President of Finance for Colgate Latin America.

|

| REASONS FOR NOMINATION

Mr. Patrick’s experience and education make him an expert in financial matters. As the Chief Financial Officer of a successful public company, Mr. Patrick was responsible for assuring that all day-to-day financial transactions were accurately recorded, processed, and reported in all public filings. All of this requires a thorough understanding of finance, treasury, and risk management functions. In addition to his extensive financial expertise, Mr. Patrick brings to the Board executive leadership experience as a chief financial officer of a large multinational company. Mr. Patrick is considered an “audit committee financial expert” as the term is defined in Item 407(d) of Regulation S-K.

|

| | |

|

| 23

|

Independent Director

Committees:

Corporate GovernanceCompensation (Chair)

| Gerry P. Smith | Age: 5760 Director Since: 2020 | | CAREER HIGHLIGHTS | | The ODP CorpCorporation, an American office supply holding company ● Chief Executive Officer and director (a public company) since 2017. Zero100, a global coalition accelerating progress to zero-percent carbon and 100% digital supply chains ● Founding member of advisory board in 2022, and member of advisory board since 2022 Lenovo Group Limited ● Executive Vice President and Chief Operating Officer from 2016 to 2017. ● Executive Vice President and President of Data Center Group in 2016. ● Chief Operating Officer of the Personal Computing Group and Enterprise Business Group from 2015 to 2016. ● President of the Americas from 2013 to 2015. | Lenovo Group Limited (continued) ● President, North America and Senior Vice President, Global Operations from 2012 to 2013. ● Senior Vice President of Global Supply Chain from 2006 to 2012. Dell Inc. ● Served in a number of roles from 1994 to 2006. | REASONS FOR NOMINATION Mr. Smith has industry-specifictechnology-industry specific strategic, operational, and managerial expertise gained through a more than 25-year career with Lenovo and Dell. Additionally, the Board believes that Mr. Smith’s expertise in positioning companies for future growth and success, extensive leadershipglobal business management experience, and strong track record in increasing operating profit and managing complex integrations for corporations are valuable qualifications on the Board. OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW)

●The ODP Corp.Corporation |

DIRECTOR RESIGNATION POLICY The Board has adopted a Director Resignation Policy which provides that in an uncontested election, any director nominee that receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” his or her election must tender a letter of resignation to the Board within five days of the certification of the shareholder vote.vote for consideration by the Corporate Governance Committee. The Corporate Governance Committee must then consider whether to recommend that the Board accept or reject the director’s resignation and promptly make such a recommendation to the Board.recommendation. The Board willmust then considertake action with respect to the resignation within 90 days following the date of the shareholders’ meeting at which the election occurred and then shall publicly disclose its decision.decision in a Form 8-K filed with the SEC. A director whose resignation is under consideration may not participate in any deliberationthe deliberations of the Corporate Governance Committee or Board regarding his or her resignation. The Director Resignation Policy can be found under “Governance Documents” at the “Leadership &and Governance” sub-link of the InvestorsInvestor Relations drop-down menu on investor.arrow.com. 24 |

| |

THE BOARD AND ITS COMMITTEES TheIn 2023, the Board meets inmet in: (i) general sessions withpresided over by the Chairman ofExecutive Chair (for sessions prior to the 2023 annual shareholder meeting) and independent Board presiding, inChair (for sessions after the 2023 annual shareholder meeting), (ii) meetings limited to non- management directors (which aremeetings were presided over by the Lead Director)Independent Director prior to the 2023 annual shareholder meeting and presided over by the independent Board Chair after the 2023 annual shareholder meeting), and (iii) in its three various committees. Committee meetings are open to all members of the Board.Board other than management directors during the sessions of the non-management directors of such committee meetings.

Committee memberships and chair assignments are reviewed no less than annually by the Corporate Governance Committee, which makes appointmentcommittee appointments and chair recommendations to the Board. The table below reflectsshows current committee memberships for calendar year 2020.as of the date of this Proxy Statement. | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

| Committee | Name |

| Independent |

| Audit |

| Compensation |

| Corporate

Governance | Barry W. Perry

|

| X

|

|

|

| M

|

|

| William F. Austen (1) | | X | | | | M | | C

| Fabian T. Garcia | | X | | | | M | | | Steven H. Gunby (1) | | X | | M

| | C

| | | Gail E. Hamilton | | X | | M | | | | M | Richard S. Hill

|

| X

|

|

|

| M

|

| M

| M. F. (Fran) Keeth

|

| X

|

| C

|

|

|

|

| Andrew C. Kerin | | X | | | |

|

| C

| Laurel J. Krzeminski

|

| X

|

| M | |

|

|

| Michael J. Long

|

|

|

|

|

|

|

|

| Stephen C. Patrick

|

| X

|

| M

|

|

|

| M | Gerry P. Smith (2)Sean J. Kerins

| | | | | | | | | Carol P. Lowe | | X | | C

| | | | M | Mary T. McDowell | | X | | M | | | | | Gerry P. Smith | | X | | | | C | | |

C= Chair M= Member | (1) | Mr. AustenGunby was appointed to serve as independent Board Chair at the Audit Committee on May 13, 2020.meeting of the Board immediately following the 2023 annual shareholder meeting. |

BOARD LEADERSHIP STRUCTURE The Board annually elects a Chair after taking into account the recommendation of the Corporate Governance Committee following its annual review of the Board’s leadership structure, which typically takes place immediately after the annual shareholder meeting. Among other responsibilities, the Board Chair: | ● | acts as the key liaison between the Board and management; |

| (2)● | Mr. Smith was appointed tosets timing, location, and agendas for meetings of the Board (in consultation with senior management of the Company and committee chairs); |

| ● | sets the agenda and chairs all executive sessions of the independent directors; |

| ● | presides over Board and shareholder meetings; |

| ● | works closely with the Corporate Governance Committee on September 17, 2020.to recommend committee chairs and committee assignments; |

|

| 25 |

| ● | assists the Corporate Governance Committee in evaluating whether to nominate additional directors for Board membership; and |

| ● | may call special meetings of the Board. |

In accordance withThe Company does not require the Company’s corporate governance guidelines,separation of its Chair and CEO positions, but they are currently separate. The Board believes it is in the best interests of the Company to determine the separation of its Chair and CEO position based upon the circumstances at the time. As described under “Proxy Statement Highlights – Board Leadership Transition” above, in 2023 Mr. Long concluded his service as Executive Chair and a member of the Board at the conclusion of the 2023 annual shareholder meeting on May 17, 2023, and the Board appointed Mr. Perry to serveGunby as independent Board Chair immediately following the Lead Director. The Lead Director chairs2023 annual shareholder meeting.

In situations where the Board meetings when the Chair is not present. He also chairsindependent, the sessions of the non-management directors held in connection with each regularly scheduled Board meeting. The Lead Director serves as a liaison between the Chair and the independent, non-management directors, and reviews and approves Board agendas and meeting schedules. The Lead Director has the authority to call meetings of the non-management directors. Additionally, as a matter of practice,Company’s Corporate Governance Guidelines suggest the Board holds executive sessions chaired by theappoint a Lead Director at every in-person Board meeting.Independent Director. | | | | 26

|

|

|

CHIEF EXECUTIVE OFFICER AND CHAIRMAN POSITIONS

The Company’s CEO currently serves as Chairman of the Board. In his position as CEO, Mr. Long has primary responsibility for the day-to-day operations of the Company and provides consistent leadership on the Company’s key strategic objectives. In his role as the Board Chair, he sets the strategic priorities for the Board, presides over its meetings, and communicates the Board’s findings and guidance to management. The Board believes that the combination of these two roles is the most appropriate structure for the Company at this time because: (i) this structure provides more consistent communication and coordination throughout the organization, which results in a more effective and efficient implementation of corporate strategy; (ii) it unifies the Company’s strategy behind a single vision; (iii) the CEO is the most knowledgeable member of the Board regarding risks the Company may be facing and, in his role as Chairman, is able to facilitate the Board’s oversight of such risks; (iv) the structure has a long-standing history of serving the Company’s shareholders well through many economic cycles, business challenges, and succession of multiple leaders; (v) the Company’s current corporate governance processes, including those set forth in the various Board committee charters and corporate governance guidelines, preserve and foster independent communication amongst non-management directors as well as independent evaluations of and discussions with the Company’s senior management, including the Company’s CEO; and (vi) the role of the Lead Director, which fosters better communication among non-management directors, fortifies the Company’s corporate governance practices, making the separation of the positions of Chairman of the Board and CEO unnecessary at this time.

COMMITTEES Each of the committees of the Board operates under a charter, copies of which are available under “Governance Documents” at the “Leadership &and Governance” sub-link of the InvestorsInvestor Relations drop-down menu on investor.arrow.com.investor.arrow.com. 26 |

| |

Audit Committee | | | Current Members | | Key Responsibilities | M. F. (Fran) Keeth,Carol P. Lowe, Chair *

William F. Austen

Steven H. Gunby

Gail E. Hamilton Laurel J. KrzeminskiMary T. McDowell

Stephen C. Patrick

| | > reviews with management and the Company’s independent auditor the Company’s annual and quarterly financial statements and recommends to the Board whether such financial statements should be included in the Company’s periodic reports filed with the SEC > reviews and evaluates Arrow’s financial reporting process and other matters, including its accounting policies, reporting practices, and internal accounting and disclosure controls > reviews Arrow’s sustainability disclosures, including relevant environmental, social, and governanceESG metrics > overseasoversees Arrow’s data privacy and cybersecurity programs

> reviews the independent auditor’s qualifications and independence and monitors the scope and reviews the results of the audit conducted by Arrow’s independent registered public accounting firmauditor > exercises oversight of related-person transactions > oversees Arrow’s ethics and compliance program and reporting > reviews ongoing assessments of the Company’s risk management processes and reviews material risks and contingent liabilities > oversees and monitors compliance with legal and regulatory requirements > reviews the Company’s disclosures containing ESG metrics and monitors the appropriateness of internal control procedures and methodologies used to prepare or develop ESG metrics > reviews the following with the Corporate Audit Department (which reports to the Audit Committee) and management: o>

the scope of the annual corporate audit plan; o>

the results of the audits carried out by the Corporate Audit Department, including its assessments of the adequacy and effectiveness of disclosure controls and procedures, and internal control over financial reporting;Department; and o>

the sufficiency of the Corporate Audit Department’s resources.resources |

The Board has determined that Mrs. Keeth, Ms. Krzeminski, and Mr. Patrick are qualified as “audit committee financial experts,” as the term is defined in Item 407(d) of Regulation S-K.

| | |

|

| 27

|

Compensation Committee

| | | Key Activities in 2023 |

| | ● Supervised Arrow’s ethics and compliance program, including regular review of whistleblower hotline complaints ● Received regular cybersecurity updates from management and discussed cybersecurity risk ● Reviewed and recommended to the Board expansion of the Company’s share repurchase program and approval of other financing transactions ● Reviewed and recommended to the Board updates to its committee charter ● Received regular updates from management on legal and regulatory developments ● Adopted improvements to the Company’s disclosure controls and procedures, including relating to evaluation of cybersecurity incidents for required disclosure |

* | The Board has determined that Ms. Lowe is qualified as an “audit committee financial expert,” as the term is defined in Item 407(d) of Regulation S-K. |

|

| 27 |

Compensation Committee | | | Current Members | | Key Responsibilities | Steven H. Gunby,Gerry P. Smith, Chair

Richard S. HillWilliam F. Austen

Barry W. PerryFabian T. Garcia

Andrew C. Kerin | | > develops and reviews Arrow’s executive compensation philosophy > implements compensation philosophy through compensation programs and plans to further Arrow’s strategy, drive long-term profit growth, and increase shareholder value > reviews and approves the corporate goals and objectives relevant to executive compensation > subject to review and ratification by all non-management Board members, reviews and approves the base salary, annual cash incentives, performance and stock-based awards, retirement, and other benefits for the Company’s principal executives > reviews the performance of each of the NEOs and the Company as a whole > overseasoversees the development, implementation, effectiveness, and disclosurereview of Arrow’s programs, practices, risks and strategiesopportunities, measures, objectives, and performance relating to human capital management and related disclosure

|

| | | Key Activities in 2023 |

| | ● Managed compensation-related decisions to facilitate successful leadership transitions ● Received regular updates from management on the Company’s human capital strategy and oversaw the development of the human-capital related disclosures in Arrow’s ESG report ● Reviewed and recommended to the Board the adoption of a Dodd-Frank compensation clawback policy, updates to its existing incentive compensation clawback policy, and updates to its committee charter |

The Compensation Committee may delegate authority from time to time to a subcommittee of one or more members of the Compensation Committee or to the CEO, if and when the Committee deems appropriate and in accordance with its charter and applicable rules and regulations. In 2020,2023, the Compensation Committee directly engaged Pearl Meyer & Partners (“Pearl Meyer”) as a consultant to examine and report to the Compensation Committee on best practices in the alignment of compensation programs for the CEO and other members of senior management by providing competitive benchmarking data, analyses, and recommendations with regard to plan design and target compensation. In addition, Pearl Meyer provides guidance to the Corporate Governance Committee regarding non-management director compensation. Pearl Meyer does not provide any other services to the Company. TheseThe Company has determined that the services rendered by Pearl Meyer have not raisedand do not raise any conflicts of interest. 28 |

| |

Corporate Governance Committee | | | Current Members | | Key Responsibilities | William F. Austen, Chair Gail E. Hamilton Andrew C. Kerin Chair Gail E. HamiltonCarol P. Lowe

Richard S. Hill

Stephen C. Patrick

Gerry P. Smith

| | > develops, the corporate governance guidelines for Arrowimplements, and monitors Arrow’s Corporate Governance Guidelines > makes recommendations with respect to committee assignments, Company officer appointments, and other governance issues > identifies and evaluates each director nominees and candidates before recommending him or hernominees for election to the Board as nominees for re-electionor to fill existing or expected director vacancies > reviews and makes recommendations to the Board regarding the compensation of non-management directors > identifies and recommends new candidatesengages in succession planning for nomination to fill existing or expected director vacanciesthe Company’s CEO

> overseasreviews and assesses the adequacy of Arrow’s code of business conduct and ethics

> oversees the self-evaluation processes of the Board and its committees > oversees significant shareholder engagement matters > oversees Arrow’s programs, policies, practices, risks and practicesopportunities, measures, objectives and performance relating to corporate social responsibilityESG matters and sustainabilityrelated disclosures to the extent not specifically delegated to other committees

|

| | | | Key Activities in 2023 |

| | ● Recommended the appointment of an independent Board Chair ● Identified, reviewed, and recommended for the Board’s nomination, a new independent director in 2023, Mary T. McDowell ● Reviewed the Company’s ESG developments and oversaw the preparation and publication of the Company’s ESG report ● Reviewed and recommended to the Board approval of updates to the Company’s Worldwide Code of Business Conduct and Ethics, Corporate Governance Guidelines, its committee charter, and various other internal policies and procedures ● Helped facilitate certain management changes during 2023 by recommending such changes to the Board ● Reviewed and recommended to the Board modifications to the compensation of the Company’s independent Board Chair to ensure the compensation for such position remains competitive |

|

| 29 |

The Corporate Governance Committee considers shareholder recommendations of nominees for membership on the Board as well as those recommended by current directors, officers, employees, and others. Such recommendations may be submitted to Arrow’s Corporate Secretary, Carine L. Jean-Claude, at Arrow Electronics, Inc., 9201 East Dry Creek Road, Centennial, Colorado 80112, who will forward them to the Corporate Governance Committee. Possible candidates suggested by shareholders are evaluated by the Corporate Governance Committee in the same manner as other possible candidates.

The Corporate Governance Committee has retained the services of a third-party executive recruitment firm to assist its members in the identification and evaluation of potential nominees for the Board. The Corporate Governance Committee’s initial review of a potential candidate is typically based on any written materials provided to it. The committee then determines whether to interview the nominee. If warranted, the Corporate Governance Committee, the Chairman of the Board and CEO, the Lead Director, and others, as appropriate, interview the potential nominees.

The Corporate Governance Committee’s expectations as to the specific qualities and skills required for directors, including those nominated by shareholders, are set forth in Section 4 of Arrow’s corporate governance guidelines (available under “Governance Documents” at the “Leadership & Governance” sub-link of the Investors drop-down menu on investor.arrow.com).